MLMExperiment

A place to store and share the code I wrote to analyze the data generated by a recent Amazon Mechanical Turk survey experiment. The analysis from this experiment was recently accepted for publication as "Income Disclosure and Consumer Judgment in a Multi-level Marketing Experiment" in Journal of Consumer Affairs.

MLM Disclosure Experiment- Analysis Document

Austin Miller 8/4/2022

- Introduction

- Load Packages

- Read Data

- Income Disclosure Effects on All Dependent Variables

- Justification for Logarithmic Transforms

- Alternative Interest Specifications

- Heterogeneous Treatment Effects

- Thinking About Earnings on Interest

Introduction

This document presents the R script that I wrote to analyze the data generated by a recent Amazon Mechanical Turk survey experiment. The goal of the analysis is to assess the impact of voluntary income disclosures in MLM marketing materials on consumer interest and earnings expectations. All participants were introduced to an MLM opportunity using marketing materials from the website of an actual MLM firm. The control group did not receive any income disclosure information; treatment group 1 received the income disclosure document created by the MLM firm itself; and treatment group 2 received an augmented form of the firm’s income disclosure information that included a graph and presented how many participants in the firm actually earned zero dollars. The analysis from this experiment was recently accepted for publication as “Income Disclosure and Consumer Judgment in a Multi-level Marketing Experiment” in Journal of Consumer Affairs.

Load Packages

library(tidyverse)

library(stringr)

library(modelr)

library(broom)

library(lmtest)

library(sandwich)

library(stargazer)

library(shiny)

I don’t know if this script actually uses each of these packages; many of them are just included in most of my R scripts by default.

Read Data

mlm <- readRDS("mlm_2022_clean.rds")

This line reads in the data created by the MLMExperiment_data.Rmd

document.

dependents <- c("interest","earnings","earnleast","earnmost","over6","expenses")

controls <- c("woman","age","education","income","black","white","hispanic","relig","earnbta",

"numeracy","finance","EVtest","risk","knownMLM","wasMLM")

The first thing I do is create some groups of variables so I can work

with a group at a time rather than listing all variables every time. The

full mlm data frame actually contains 190 variables, but most of those

are the raw variables from Qualtrics and are not used. I keep them

around in the principle of non-destructive editing, I suppose. If I

decide that I want to create a new variable or re-transform something,

etc. (which I do a lot over the course of a project), then I don’t have

to go back and look for stuff in the original raw data or change the

line of code that keeps only “important” variables.

Income Disclosure Effects on All Dependent Variables

These models represent the main analysis of the paper. I regress each dependent variable on whether a person was exposed to either treatment.

Most of my linear regression analyses follow three steps:

- fit the model

- estimate robust standard errors

- display results in a clean table

Fit the models

m_interest_c <- lm(linterest ~ ., data = mlm %>%

select(linterest, treatment, all_of(controls)))

m_interest_t2 <- lm(linterest ~ ., data = mlm %>%

filter(treatment != "No Disclosure") %>%

select(linterest, treatment, all_of(controls)))

m_earnings_c <- lm(learnings ~ ., data = mlm %>%

select(learnings, treatment, all_of(controls)))

m_earnings_t2 <- lm(learnings ~ ., data = mlm %>%

filter(treatment != "No Disclosure") %>%

select(learnings, treatment, all_of(controls)))

m_earnmost_c <- lm(learnmost ~ ., data = mlm %>%

select(learnmost, treatment, all_of(controls)))

m_earnmost_t2 <- lm(learnmost ~ ., data = mlm %>%

filter(treatment != "No Disclosure") %>%

select(learnmost, treatment, all_of(controls)))

m_earnleast_c <- lm(learnleast ~ ., data = mlm %>%

select(learnleast, treatment, all_of(controls)))

m_earnleast_t2 <- lm(learnleast ~ ., data = mlm %>%

filter(treatment != "No Disclosure") %>%

select(learnleast, treatment, all_of(controls)))

m_over6_c <- lm(lover6 ~ ., data = mlm %>%

select(lover6, treatment, all_of(controls)))

m_over6_t2 <- lm(lover6 ~ ., data = mlm %>%

filter(treatment != "No Disclosure") %>%

select(lover6, treatment, all_of(controls)))

m_expenses_c <- lm(lexpenses ~ ., data = mlm %>%

select(lexpenses, treatment, all_of(controls)))

m_expenses_t2 <- lm(lexpenses ~ ., data = mlm %>%

filter(treatment != "No Disclosure") %>%

select(lexpenses, treatment, all_of(controls)))

Here I fit two lm() models for each dependent variable: m_*_c

includes all the data and estimates whether the intent-to-treat effect

of either treatment is likely different from zero, and m_*_t2 excludes

observations from the control group ("No Disclosure") to estimate

whether the observed effect of treatment 2 is likely different from the

average effect of treatment 1. All models use the logarithm of the

dependent variable and include all of the control variables.

Estimate Robust Standard Errors

ses_c <- list()

ses_c <- append(ses_c, list(sqrt(diag(vcovHC(m_interest_c, type = "HC1")))))

ses_c <- append(ses_c, list(sqrt(diag(vcovHC(m_earnings_c, type = "HC1")))))

ses_c <- append(ses_c, list(sqrt(diag(vcovHC(m_earnmost_c, type = "HC1")))))

ses_c <- append(ses_c, list(sqrt(diag(vcovHC(m_earnleast_c, type = "HC1")))))

ses_c <- append(ses_c, list(sqrt(diag(vcovHC(m_over6_c, type = "HC1")))))

ses_c <- append(ses_c, list(sqrt(diag(vcovHC(m_expenses_c, type = "HC1")))))

ses_t2 <- list()

ses_t2 <- append(ses_c, list(sqrt(diag(vcovHC(m_interest_t2, type = "HC1")))))

ses_t2 <- append(ses_c, list(sqrt(diag(vcovHC(m_earnings_t2, type = "HC1")))))

ses_t2 <- append(ses_c, list(sqrt(diag(vcovHC(m_earnmost_t2, type = "HC1")))))

ses_t2 <- append(ses_c, list(sqrt(diag(vcovHC(m_earnleast_t2, type = "HC1")))))

ses_t2 <- append(ses_c, list(sqrt(diag(vcovHC(m_over6_t2, type = "HC1")))))

ses_t2 <- append(ses_c, list(sqrt(diag(vcovHC(m_expenses_t2, type = "HC1")))))

Here I create lists of all the standard errors for the coefficients in

each regression model (two lists of six models each). In each case, I

start with the vcovHC() function from sandwich, which estimates a

heteroscedasticity-consistent variance-covariance matrix for the given

model. "HC1" denotes MacKinnon & White

(1985)’s method, which

adjusts for degrees of freedom. I then isolate the variances from the

matrix, which are in the diagonal diag(), and take the square root

sqrt() to turn these variances into standard deviations. The result is

a list of standard errors for each model, which I append into two lists

of six lists.

Format Output

stargazer(m_interest_c, m_earnings_c, m_earnmost_c, m_earnleast_c, m_over6_c, m_expenses_c,

se = ses_c,

#apply.coef = exp,

keep = c("Company Disclosure", "Graphical Disclosure"),

header=FALSE,

model.numbers = FALSE,

dep.var.labels = c("Interest", "Typical" , "Most", "Least", "Over", "Expenses"),

column.labels = c("", "Earnings" ,"Earnings", "Earnings", "6,000", ""),

covariate.labels = c("Company Disclosure", "Graphical Disclosure"),

digits = 2,

digits.extra = 1,

omit.stat = c("f","rsq","ser"),

report= c("vc*sp"),

#report= c("vc"),

notes.align = "l",

type = "text")

##

## ============================================================================

## Dependent variable:

## -------------------------------------------------------

## Interest Typical Most Least Over Expenses

## Earnings Earnings Earnings 6,000

## ----------------------------------------------------------------------------

## Company Disclosure -0.04 -0.54** -0.03 0.19 -0.05** -0.18

## (0.06) (0.25) (0.28) (0.32) (0.02) (0.16)

## p = 0.53 p = 0.03 p = 0.92 p = 0.56 p = 0.02 p = 0.27

##

## Graphical Disclosure -0.08 -1.60*** -0.71** -1.70*** -0.11*** -0.22

## (0.06) (0.30) (0.29) (0.35) (0.02) (0.18)

## p = 0.18 p = 0.000 p = 0.02 p = 0.000 p = 0.00 p = 0.23

##

## ----------------------------------------------------------------------------

## Observations 545 545 545 545 545 381

## Adjusted R2 0.18 0.16 0.06 0.18 0.25 0.02

## ============================================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

The last step is to combine the models with the robust standard errors

to include hypothesis tests for each variable of interest. stargazer()

will calculate p-values from the supplied list of standard errors and

display asterisks in the table accordingly. I also monkey with the

settings of stargazer() to format the table in a way that I like. I

only keep the coefficients on each treatment, choosing not to display

here the coefficients on the control variables. I change the labels on

columns and rows, adjust the digits displayed after the decimal, and

choose which statistics to include and exclude in the table. "vc*sp"

indicates the inclusion of the variable name v, the estimated slope

coefficient c, a number of asterisks * related to the size of the

p-value, the robust standard error supplied s, and the calculated

p-value p for each variable displayed.

This first table displays the estimated intention-to-treat effects of both treatments on each of the six dependent variables. The first row contains the estimated effects of the company-produced disclosure; the second row shows those of the graphical disclosure. Generally, we find no significant effect of income disclosure on subjects’ interest in the MLM opportunity, on average. Both treatments have a significant effect on estimated Typical Earnings, and on the estimated likelihood of earning over $6,000 in a year. Only the graphical disclosure has a significant effect on the average Most Earnings and Least Earnings. Finally, as expected, we observe no meaningful difference in the estimates of expenses between disclosure groups.

Because of the logarithmic transformation, when the values of these

coefficients are relatively small, they can be interpreted as percentage

changes in the dependent variable due to treatment. For larger values,

it is more accurate to exponentiate the coefficients exp() before

interpretation. The exponentiated coefficients are then interpreted as

the ratio of the geometric means of the dependent variable between the

corresponding treatment group and the control group.

stargazer(m_interest_c, m_earnings_c, m_earnmost_c, m_earnleast_c, m_over6_c, m_expenses_c,

#se = ses_c,

apply.coef = exp,

keep = c("Company Disclosure", "Graphical Disclosure"),

header=FALSE,

model.numbers = FALSE,

dep.var.labels = c("Interest", "Typical" , "Most", "Least", "Over", "Expenses"),

column.labels = c("", "Earnings" ,"Earnings", "Earnings", "6,000", ""),

covariate.labels = c("Company Disclosure", "Graphical Disclosure"),

digits = 2,

digits.extra = 1,

omit.stat = c("f","rsq","ser"),

#report= c("vc*sp"),

report= c("vc"),

notes.align = "l",

type = "text")

##

## =======================================================================

## Dependent variable:

## --------------------------------------------------

## Interest Typical Most Least Over Expenses

## Earnings Earnings Earnings 6,000

## -----------------------------------------------------------------------

## Company Disclosure 0.96 0.58 0.97 1.21 0.96 0.83

##

## Graphical Disclosure 0.92 0.20 0.49 0.18 0.90 0.81

##

## -----------------------------------------------------------------------

## Observations 545 545 545 545 545 381

## Adjusted R2 0.18 0.16 0.06 0.18 0.25 0.02

## =======================================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

I add the option apply.coef = exp to display exponentiated

coefficients, but I remove *sp from the report because these values

will not correspond to the exponentiated values.

The company disclosure results in estimated earnings that are about 58 percent of the earnings reported by those in the control group, and the graphical disclosure results in estimated earnings that are about 20 percent of those reported in the control group. The graphical disclosure reduces both Most Earnings by half and Least Earnings by 82 percent (1 - 0.18 = 0.82). We also see that the company-disclosure treatment reduces the estimated likelihood of earning over $6,000 in a year by about 5 percent relative to no disclosure, and the graphical disclosure reduces the likelihood by about 11 percent (essentially a one-half bin and full bin decrease, respectively).

stargazer(m_interest_t2, m_earnings_t2, m_earnmost_t2, m_earnleast_t2, m_over6_t2, m_expenses_t2,

se = ses_t2,

keep = c("Graphical Disclosure"),

header=FALSE,

model.numbers = FALSE,

dep.var.labels = c("Interest", "Typical" , "Most", "Least", "Over", "Expenses"),

column.labels = c("", "Earnings" ,"Earnings", "Earnings", "6,000", ""),

covariate.labels = c("Graphical Disclosure"),

digits = 2,

digits.extra = 1,

omit.stat = c("f","rsq","ser"),

report= c("vc*sp"),

notes.align = "l",

type = "text")

##

## =============================================================================

## Dependent variable:

## --------------------------------------------------------

## Interest Typical Most Least Over Expenses

## Earnings Earnings Earnings 6,000

## -----------------------------------------------------------------------------

## Graphical Disclosure -0.03 -1.03*** -0.65** -1.80*** -0.06*** -0.03

## (0.06) (0.30) (0.29) (0.35) (0.02) (0.18)

## p = 0.60 p = 0.001 p = 0.03 p = 0.000 p = 0.002 p = 0.89

##

## -----------------------------------------------------------------------------

## Observations 366 366 366 366 366 248

## Adjusted R2 0.18 0.17 0.06 0.17 0.24 -0.002

## =============================================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

This table displays the results of tests for whether the estimated treatment effects are different for the graphical-disclosure treatment relative to the company-disclosure treatment. The difference between the effects of these two treatments is statistically significant for Typical Earnings, Most Earnings, Least Earnings, and the likelihood of earning over $6,000 in a year.

Justification for Logarithmic Transforms

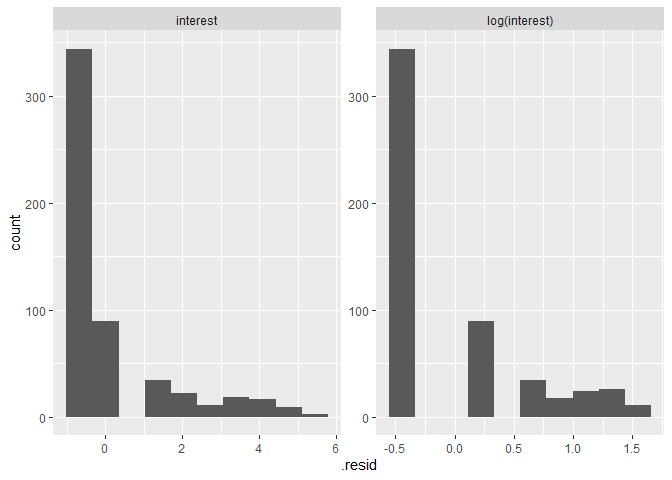

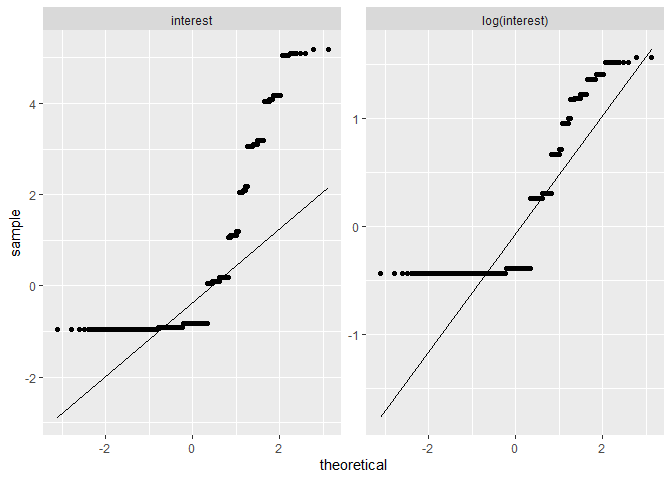

one reason for transforming the dependent variables is because of their skew. The linear regression models assume that errors are distributed normally. The following analysis shows how the logarithmic transform results in more normally distributed residuals in most cases.

m_interest_ <- lm(interest ~ treatment, data = mlm)

m_interest <- lm(linterest ~ treatment, data = mlm)

interest_results <- augment(m_interest_, mlm %>%

filter(!is.na(interest))

) %>%

mutate(model = "interest")

linterest_results <- augment(m_interest, mlm %>%

filter(!is.na(interest))

) %>%

mutate(model = "log(interest)")

compare_interest_models <- rbind(interest_results, linterest_results) %>%

mutate(model = as_factor(model) %>%

fct_relevel("interest")

)

ggplot(compare_interest_models) +

geom_histogram(aes(.resid), bins = 10) +

facet_wrap(~model, scales = "free")

ggplot(compare_interest_models, aes(sample = .resid)) +

stat_qq() +

stat_qq_line() +

facet_wrap(~model, scales = "free")

This section calculates residuals for two competing models: one with

original interest measured on a seven-point scale with the majority of

responses having a value of 1, which indicates

"1- No Interest At All", and one with the logarithm of interest as the

dependent variable. Residuals also tend to be much normal–and harder to

compare–in models that include the control variables so I omit them for

now. The augment() function calculates predicted values and residuals

for every non-missing observation in the data. I do this for both models

and then rbind() the two augmented data frames together, using the

newly created variable model to differentiate which residuals come

from which model. Finally, I create two sets of graphs to visually

evaluate the normality of the calculated residuals. The first set of

graphs displays a histogram of the residuals for each model. The second

set of graphs displays a Q-Q plot for each model, in which each dot

represents an observation and dots closer to the superimposed line

indicate values that are more consistent with a normal distribution.

The distribution of residuals when regressing log(interest) on

treatment appears slightly more normal than the models of interest

on treatment. The following section repeats this process for each

dependent variable.

You can see that generally the logarithmic transformation results in more normal residuals.

Alternative Interest Specifications

Because interest is measure on a seven-point Likert-type scale, I

present two alternative models with different assumptions that may be

more fitting than the typical linear model.

Ordered Logit

The linear model assumes that the distance between values of interest

is meaningful and that the distance between any two adjacent values is

equal. The ordered logit model treats each value as a separate category

where only the order matters. The test of a coefficient in this model is

whether a one-unit increase in the independent variable results in a

change in the likelihood (log-odds) of being in a higher category? In

this case, a one-unit increase is equivalent to being in one or the

other treatment group relative to the control group.

library(MASS)

##

## Attaching package: 'MASS'

## The following object is masked from 'package:dplyr':

##

## select

ol_int <- polr(as.factor(interest) ~ treatment, data= mlm)

ol_int_c <- polr(as.factor(interest) ~ ., data = mlm %>%

dplyr::select(interest, treatment, all_of(controls)))

stargazer(ol_int, ol_int_c,

keep = c("Company Disclosure", "Graphical Disclosure"),

header=FALSE,

model.numbers = FALSE,

dep.var.labels = "Ordered Interest Categories",

covariate.labels = c("Company Disclosure", "Graphical Disclosure"),

digits = 2,

digits.extra = 1,

report= c("vc*sp"),

notes.align = "l",

add.lines = list(c("Controls", "", "X")),

type= "text")

##

## =================================================

## Dependent variable:

## ----------------------------

## Ordered Interest Categories

## -------------------------------------------------

## Company Disclosure -0.16 -0.11

## (0.21) (0.22)

## p = 0.45 p = 0.62

##

## Graphical Disclosure -0.07 -0.31

## (0.21) (0.23)

## p = 0.74 p = 0.18

##

## -------------------------------------------------

## Controls X

## Observations 545 545

## =================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

detach("package:MASS", unload=TRUE)

To estimate an ordered logit model, I use polr() from the MASS

package. Because this package also has a function named select() that

interferes with select() from dplyr, I have to qualify which

select() I intend to use here. This is also why I don’t load this

package at the beginning of the script and why I unload it as soon as I

am done with it. I also estimate this model both with and without

control variables.

We continue to not observe any significant effects of income disclosure treatment on interest in that neither treatment seems to affect the log-odds of being in a higher category of interest.

Interest Greater Than 1

Because most respondents report having an interest of

"1- No Interest At All", I also estimate a model for whether treatment

affects the odds of having any interest that is greater than 1.

bin_int <- glm(interestover1 ~ treatment

, data = mlm

, family = "binomial")

bin_int_c <- glm(interestover1 ~ .

, data = mlm %>%

select(interestover1, treatment, all_of(controls))

, family = "binomial")

stargazer(bin_int, bin_int_c,

keep = c("Company Disclosure", "Graphical Disclosure"),

header = FALSE,

model.numbers = FALSE,

dep.var.labels = "Prob(Interest >1)",

covariate.labels = c("Company Disclosure", "Graphical Disclosure"),

digits = 2,

digits.extra = 1,

report = c("vc*sp"),

notes.align = "l",

add.lines = list(c("Controls", "", "X")),

type = "text")

##

## =================================================

## Dependent variable:

## ----------------------------

## Prob(Interest >1)

## -------------------------------------------------

## Company Disclosure -0.15 -0.13

## (0.22) (0.24)

## p = 0.50 p = 0.61

##

## Graphical Disclosure -0.14 -0.41

## (0.22) (0.25)

## p = 0.54 p = 0.11

##

## -------------------------------------------------

## Controls X

## Observations 545 545

## Log Likelihood -358.50 -308.39

## Akaike Inf. Crit. 723.00 660.78

## =================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

This is a logistic regression model of a binary variable on treatment. I

use glm(..., family = "binomial") to estimate it. I also estimate this

model both with and without control variables.

Again, we do not observe any significant average effect of treatment on interest. It seems that most people are either uninterested or interested regardless of the income disclosure.

Heterogeneous Treatment Effects

An income disclosure may interact with consumer characteristics, needs, and knowledge. Different consumers may be looking for different information, and consumer comprehension and use may vary based on individual characteristics including specific prior knowledge or beliefs, age, or gender. If consumers find it difficult to understand a disclosure due to its complexity, level of detail, or the need for prerequisite knowledge, they may not use the disclosure in judgment formation or decision making. Alternatively, such consumers may make faulty inferences from the disclosure. In this experiment, relevant knowledge is represented by educational attainment, financial literacy, numeracy, and understanding of expected value.

Additionally, the effect of the income disclosure may be affected by a consumer’s self-perception. Individuals who perceive themselves as better-than-average may be more likely to perceive low probability, high earnings outcomes presented in the disclosure as achievable. For these consumers, the disclosure of past high earners—despite their low frequency—may elevate their personal expectations. We have observed that disclosure significantly lowered earnings expectations on average, but that expectations for a small subset seem to be inflated by disclosure. This may be partially due to a better-than-average effect.

m_int <- lm(linterest ~ treatment*numeracy, data = mlm)

m_int_c <- lm(linterest ~ treatment*numeracy +

woman + age + income + black + white + hispanic +

relig + risk + knownMLM + wasMLM, data = mlm)

m_earn <- lm(learnings ~ treatment*numeracy, data = mlm)

m_earn_c <- lm(learnings ~ treatment*numeracy +

woman + age + income + black + white + hispanic +

relig + risk + knownMLM + wasMLM, data = mlm)

ses_h <- list()

ses_h <- append(ses_h, list(sqrt(diag(vcovHC(m_int, type = "HC1")))))

ses_h <- append(ses_h, list(sqrt(diag(vcovHC(m_int_c, type = "HC1")))))

ses_h <- append(ses_h, list(sqrt(diag(vcovHC(m_earn, type = "HC1")))))

ses_h <- append(ses_h, list(sqrt(diag(vcovHC(m_earn_c, type = "HC1")))))

stargazer(m_int, m_int_c, m_earn, m_earn_c,

se = ses_h,

keep = c("Company Disclosure", "Graphical Disclosure", "numeracy"),

header = FALSE,

model.numbers = FALSE,

dep.var.labels.include = FALSE,

column.labels = c("Interest", "Interest", "Earnings", "Earnings"),

covariate.labels = c("Treatment 1", "Treatment 2", "Numeracy",

"Treatment 1 x Numeracy", "Treatment 2 x Numeracy"),

digits = 2,

omit.stat = c("f","ser","rsq"),

report = c("vc*sp"),

notes.align = "l",

add.lines = list(c("Controls", "", "X", "", "X")),

type = "text")

##

## ==========================================================

## Dependent variable:

## -----------------------------------

## Interest Interest Earnings Earnings

## ----------------------------------------------------------

## Treatment 1 -0.08 -0.11 -0.13 -0.25

## (0.18) (0.18) (0.84) (0.82)

## p = 0.66 p = 0.54 p = 0.88 p = 0.76

##

## Treatment 2 0.39** 0.31 0.89 0.69

## (0.19) (0.19) (0.87) (0.87)

## p = 0.04 p = 0.11 p = 0.31 p = 0.43

##

## Numeracy -0.03 -0.03 0.08 0.07

## (0.05) (0.06) (0.26) (0.27)

## p = 0.57 p = 0.62 p = 0.76 p = 0.80

##

## Treatment 1 x Numeracy 0.02 0.03 -0.22 -0.14

## (0.07) (0.07) (0.33) (0.33)

## p = 0.85 p = 0.68 p = 0.52 p = 0.68

##

## Treatment 2 x Numeracy -0.17** -0.15** -0.96*** -0.89**

## (0.07) (0.07) (0.36) (0.36)

## p = 0.02 p = 0.05 p = 0.01 p = 0.02

##

## ----------------------------------------------------------

## Controls X X

## Observations 545 545 545 545

## Adjusted R2 0.02 0.09 0.05 0.08

## ==========================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

This model expands the basic intention-to-treat models by separating

heterogeneous treatment effects across levels of numeracy. This is

accomplished by including interactions of both treatments with numeracy

level (the individual’s numeracy score between zero and three). The

control variables here do not include other measures of consumer

knowledge, but I test the interaction of treatment with these other

variables individually in the next section.

The significant interaction term of numeracy with Treatment 2 across

the board suggests that the graphical income disclosure decreases both

interest and expected earnings for those with non-zero numeracy

scores. The effect is robust to the inclusion of control variables. This

is important because we have seen that the disclosures do not have a

significant effect on interest on average. We also see that

Treatment 2 may actually increase interest for those with a numeracy

score of zero; this diverging effect helps to explain why no effect is

observed in the aggregate.

The following section repeats this heterogeneous treatment effect analysis with interaction terms for other covariates of interest.

According to these models, it seems that age interacts with interest

and treatment in a similar way as numeracy. For those younger than

45, the graphical disclosure increases interest. For those older than

45, the effect of treatment on interest is negative. This

relationship disappears when controls are included, indicating that it

is likely the knowledge gained as people age that makes the difference.

On the other hand, the magnitude of the negative effect of income

disclosure on earnings estimations tends to decrease toward zero as age

increases, potentially turning into a positive effect for those over

about age 60. This interaction effect is robust to the inclusion of

control variables in the case of the non-graphical, company-produced

disclosure.

We mostly observe no significant interaction effects for gender, education, or financial literacy. One exception is for those who took some college classes but never got a degree. The effect of the company-produced disclosure on estimated earnings is negative for most people, but much smaller and potentially positive for those with a little bit of college experience. The other exception is that the treatment effect of the graphical disclosure on earnings is more negative for those who are able to correctly answer a question about expected value, but the statistical significance of this effect drops off when other controls are included.

Lastly, we observe a large positive effect of a better-than-average

self-perception on both interest and earnings. When controls are

included, we also observe that this better-than-average effect reverses

the negative effect of the graphical disclosure on estimated earnings.

In other words, those who expect that they will earn more than the

average participant have even higher estimated earnings than others if

they see the graphical income disclosure.

The last set of regressions here combine the effects of numeracy and

earnbta into a single model.

m_int <- lm(linterest ~ treatment*numeracy + treatment*earnbta4, data= mlm)

m_int_c <- lm(linterest ~ treatment*numeracy + treatment*earnbta4 +

woman + age + income + black + white + hispanic +

relig + risk + knownMLM + wasMLM, data= mlm)

m_earn <- lm(learnings ~ treatment*numeracy + treatment*earnbta4, data= mlm)

m_earn_c <- lm(learnings ~ treatment*numeracy + treatment*earnbta4 +

woman + age + income + black + white + hispanic +

relig + risk + knownMLM + wasMLM, data= mlm)

ses_h <- list()

ses_h <- append(ses_h, list(sqrt(diag(vcovHC(m_int, type = "HC1")))))

ses_h <- append(ses_h, list(sqrt(diag(vcovHC(m_int_c, type = "HC1")))))

ses_h <- append(ses_h, list(sqrt(diag(vcovHC(m_earn, type = "HC1")))))

ses_h <- append(ses_h, list(sqrt(diag(vcovHC(m_earn_c, type = "HC1")))))

stargazer(m_int, m_int_c, m_earn, m_earn_c,

#apply.coef = exp,

se = ses_h,

keep = c("Company Disclosure", "Graphical Disclosure", "numeracy", "earnbta4"),

header = FALSE,

model.numbers = FALSE,

dep.var.labels.include = FALSE,

column.labels = c("Interest", "Interest", "Earnings", "Earnings"),

covariate.labels = c("Treatment 1", "Treatment 2", "Numeracy", "Better-than-Average",

"Treatment 1 x Numeracy", "Treatment 2 x Numeracy",

"Treatment 1 x Better-than-Average", "Treatment 2 x Better-than-Average"),

digits = 2,

omit.stat = c("f","ser","rsq"),

report = c("vc*sp"),

#report = c("vc"),

notes.align = "l",

add.lines = list(c("Controls", "", "X", "", "X")),

type = "text")

##

## ============================================================================

## Dependent variable:

## ------------------------------------------

## Interest Interest Earnings Earnings

## ----------------------------------------------------------------------------

## Treatment 1 -0.15 -0.17 -0.39 -0.50

## (0.17) (0.17) (0.82) (0.80)

## p = 0.39 p = 0.31 p = 0.64 p = 0.54

##

## Treatment 2 0.41** 0.32* 0.81 0.61

## (0.18) (0.18) (0.85) (0.85)

## p = 0.03 p = 0.08 p = 0.35 p = 0.48

##

## Numeracy -0.03 -0.03 0.07 0.05

## (0.05) (0.05) (0.25) (0.26)

## p = 0.51 p = 0.54 p = 0.78 p = 0.85

##

## Better-than-Average 0.72*** 0.64*** 1.95*** 1.86***

## (0.19) (0.20) (0.47) (0.52)

## p = 0.0002 p = 0.002 p = 0.0001 p = 0.0004

##

## Treatment 1 x Numeracy 0.05 0.06 -0.10 -0.02

## (0.07) (0.07) (0.32) (0.32)

## p = 0.48 p = 0.36 p = 0.75 p = 0.94

##

## Treatment 2 x Numeracy -0.18** -0.15** -0.98*** -0.91***

## (0.07) (0.07) (0.35) (0.35)

## p = 0.02 p = 0.04 p = 0.01 p = 0.01

##

## Treatment 1 x Better-than-Average 0.07 0.06 0.69 0.52

## (0.25) (0.26) (0.68) (0.65)

## p = 0.80 p = 0.83 p = 0.32 p = 0.43

##

## Treatment 2 x Better-than-Average -0.14 -0.05 1.02* 1.28**

## (0.27) (0.27) (0.59) (0.64)

## p = 0.61 p = 0.86 p = 0.09 p = 0.05

##

## ----------------------------------------------------------------------------

## Controls X X

## Observations 545 545 545 545

## Adjusted R2 0.13 0.18 0.12 0.14

## ============================================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

Notice that the variable used in these regressions for the

better-than-average effect is earnbta4, which is an indicator of

whether a respondent answered higher than

"4- I Think I Would Earn As Much As Average Participant" on the

seven-point scale.

We observe here the same patterns between numeracy and earnbta4 in

the treatment effects as discussed above in the separate regressions.

earnbta4 increases both interest and earnings across the board,

and the graphical disclosure has a varying effect on interest

depending on numeracy score and eartnbta4.

In order to better interpret the magnitude of the various effects, I display next the exponentiated coefficients from these estimations.

stargazer(m_int, m_int_c, m_earn, m_earn_c,

apply.coef = exp,

se = ses_h,

keep = c("Company Disclosure", "Graphical Disclosure", "numeracy", "earnbta4"),

header = FALSE,

model.numbers = FALSE,

dep.var.labels.include = FALSE,

column.labels = c("Interest", "Interest", "Earnings", "Earnings"),

covariate.labels = c("Treatment 1", "Treatment 2", "Numeracy", "Better-than-Average",

"Treatment 1 x Numeracy", "Treatment 2 x Numeracy",

"Treatment 1 x Better-than-Average", "Treatment 2 x Better-than-Average"),

digits = 2,

omit.stat = c("f","ser","rsq"),

#report = c("vc*sp"),

report = c("vc"),

notes.align = "l",

add.lines = list(c("Controls", "", "X", "", "X")),

type = "text")

##

## =====================================================================

## Dependent variable:

## -----------------------------------

## Interest Interest Earnings Earnings

## ---------------------------------------------------------------------

## Treatment 1 0.87 0.84 0.68 0.61

##

## Treatment 2 1.50 1.38 2.25 1.84

##

## Numeracy 0.97 0.97 1.08 1.05

##

## Better-than-Average 2.05 1.90 7.01 6.41

##

## Treatment 1 x Numeracy 1.05 1.06 0.90 0.98

##

## Treatment 2 x Numeracy 0.84 0.86 0.38 0.40

##

## Treatment 1 x Better-than-Average 1.07 1.06 1.99 1.67

##

## Treatment 2 x Better-than-Average 0.87 0.95 2.77 3.60

##

## ---------------------------------------------------------------------

## Controls X X

## Observations 545 545 545 545

## Adjusted R2 0.13 0.18 0.12 0.14

## =====================================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

For subjects with a zero numeracy score, the effect of Treatment 2 on interest is an increase of between 38 and 50 percent. As numeracy increases, this effect diminishes by about 15 percent for each additional numeracy point. For those with a perfect three-point score, the treatment effect would be negative at a decrease of about 10 percent (1-1.38*0.86^3 = 0.12 or 1-1.50*0.84^3 = 0.11). At the average numeracy score of 2.3, the treatment effect would be negligible (1-1.38*0.86^2.3 = 0.02 or 1-1.50*0.84^2.3 = -0.00). We find that those who believe their prospective earnings will be better than average tend to report interest levels that are about twice as high as others, and this pattern does not change significantly across treatment groups.

The treatment effect on estimated earnings is not statistically significant for subjects with zero numeracy and worse-or-equal-to-average perceptions of earnings potential. As numeracy increases, however, the graphical-disclosure treatment tends to lower estimated earnings by about 60 percent per correct answer. Thus, on average, after being presented with the graphical disclosure statement, those with three correct points will have earnings estimates that are about 6 percent of the level of earnings estimated by those with zero points.

For those in the control group, a better-than-average perception is already associated with earnings estimates that are six to seven times larger than others. After viewing the graphical income disclosure, those with a better-than-average perception predict earnings that are an additional two to three times larger, or a total of about twenty times (7.01*2.77 = 19.04; 6.41*3.60 = 23.1) greater than the estimated earnings of all others. These values are estimated holding numeracy constant at zero, and increasing numeracy tempers the treatment effect for those with a better-than-average perception. Specifically, at a decrease of 60 percent per numeracy point, predicted earnings after viewing the disclosure are only two to three times larger than others for those with a better-than-average perception and an average numeracy score of 2.3 (7.01*2.77*.38^2.3 = 2.1; 6.41*3.60*.40^2.3 = 2.8) and only 7 to 48 percent larger (7.01*2.77*.38^3 = 1.07; 6.41*3.60*.40^3 = 1.48) with a numeracy score of three.

Thinking About Earnings on Interest

Given the multiple factors that may motivate MLM participation (e.g., entrepreneurial orientation, reward responsiveness, materialism, relationship to recruiter, or income needs), it may not be surprising that the interest level of many people is not affected by income disclosures. To the extent that interest is tied to the desire to earn money from MLM participation, we may expect that those with lower expected earnings will also have lower interest. Additionally, if interest and expected earnings are highly correlated, we may expect that consumers exposed to MLM marketing materials who first explicitly estimate earnings will have lower interest in the MLM opportunity than those who are not prompted to estimate earnings prior to reporting interest.

Correlation of Interest and Earnings

list(cor(mlm$earnings, mlm$interest),

cor(mlm$learnings, mlm$linterest)

)

## [[1]]

## [1] 0.3812124

##

## [[2]]

## [1] 0.4245805

The correlation between interest and earnings is not what I would

classify as very high, whether logarithm-transformed or not.

intvearn <- lm(linterest ~ learnings, data = mlm)

intvearnc <- lm(linterest ~ ., data = mlm %>%

select(linterest, learnings, all_of(controls)))

seie <- sqrt(diag(vcovHC(intvearn, type = "HC1")))

seiec <- sqrt(diag(vcovHC(intvearnc, type = "HC1")))

stargazer(intvearn, intvearnc,

se = list(seie,seiec),

keep = c("learnings","Constant"),

header = FALSE,

model.numbers = FALSE,

dep.var.labels = "log(Interest)",

covariate.labels = "log(Earnings)",

digits = 2,

digits.extra = 1,

omit.stat = c("ser","f","rsq"),

report = c("vc*sp"),

notes.align = "l",

add.lines = list(c("Controls", "", "X")),

type = "text")

##

## ==========================================

## Dependent variable:

## ----------------------------

## log(Interest)

## ------------------------------------------

## log(Earnings) 0.09*** 0.07***

## (0.01) (0.01)

## p = 0.00 p = 0.00

##

## Constant -0.20*** -0.40**

## (0.04) (0.19)

## p = 0.000 p = 0.04

##

## ------------------------------------------

## Controls X

## Observations 545 545

## Adjusted R2 0.18 0.27

## ==========================================

## Note: *p<0.1; **p<0.05; ***p<0.01

Another simple regression, both with and without controls. Those with double the expected Typical Earnings of others (100 percent increase) have an average interest that is 7-9 percent higher, which could be as much as one-half of one point on a seven-point scale.

Order Effects

Finally, I examine whether being asked about earnings before interest affects a person’s interest in the MLM opportunity.

m_into <- lm(linterest ~ earnfirst, data= mlm)

m_intoc <- lm(linterest ~ ., data = mlm %>%

select(linterest, earnfirst, all_of(controls)))

m_into_h <- lm(linterest ~ earnhigh*earnfirst, data= mlm)

m_intoc_h <- lm(linterest ~ earnhigh*earnfirst + ., data = mlm %>%

select(linterest, earnfirst, earnhigh, all_of(controls)))

seo <- list()

seo <- append(seo,list(sqrt(diag(vcovHC(m_into, type = "HC1")))))

seo <- append(seo,list(sqrt(diag(vcovHC(m_intoc, type = "HC1")))))

seo <- append(seo,list(sqrt(diag(vcovHC(m_into_h, type = "HC1")))))

seo <- append(seo,list(sqrt(diag(vcovHC(m_intoc_h, type = "HC1")))))

stargazer(m_into, m_intoc, m_into_h, m_intoc_h,

se = seo,

keep = c("earnfirst", "earnhigh"),

header = FALSE,

dep.var.labels.include = FALSE,

dep.var.caption = "log(interest)",

order = c(2,1),

covariate.labels = c("Earnings First", "High Earnings Estimate", "Interaction"),

digits = 2,

digits.extra = 1,

omit.stat = c("f","ser","rsq"),

report = c("vc*sp"),

notes.align = "l",

add.lines = list(c("Controls", "", "X", "", "X")),

type = "text")

##

## ===========================================================

## log(interest)

## ------------------------------------

## (1) (2) (3) (4)

## -----------------------------------------------------------

## Earnings First -0.10** -0.09* -0.13*** -0.12**

## (0.05) (0.05) (0.05) (0.05)

## p = 0.05 p = 0.07 p = 0.01 p = 0.02

##

## High Earnings Estimate 0.48*** 0.34***

## (0.07) (0.07)

## p = 0.00 p = 0.000

##

## Interaction -0.03 0.01

## (0.10) (0.09)

## p = 0.74 p = 0.93

##

## -----------------------------------------------------------

## Controls X X

## Observations 545 545 545 545

## Adjusted R2 0.01 0.19 0.15 0.26

## ===========================================================

## Note: *p<0.1; **p<0.05; ***p<0.01

In these models, earnfirst is an indicator equal to one if the

respondent was asked earnings questions first and zero if they were

asked the interest question before being asked to consider earnings.

earnhigh is an indicator for whether a subject’s estimated annual

Typical Earnings value is higher than the median of the sample ($1,000).

Thus I estimate a heterogeneous treatment effect of question order for

two levels of estimated earnings (i.e., estimates above and below the

median of $1,000).

Respondents who are asked about earnings first have an average of 10 percent lower interest in the MLM opportunity, which is up to about two-thirds of a point on a 7-point scale. When we account for the level of estimated earnings in columns (3) and (4), the question-order effect on interest is slightly more negative at 12 to 13 percent. Those with higher-than-median earnings estimates tend to express interest that is between 40 and 60 percent higher than others (exp(0.34) = 1.40 and exp(0.48) = 1.62), but the average effect of being asked about earnings first seems to be the same for these people as evidenced by the lack of significance in the interaction term.