MLMExperiment

A place to store and share the code I wrote to analyze the data generated by a recent Amazon Mechanical Turk survey experiment. The analysis from this experiment was recently accepted for publication as "Income Disclosure and Consumer Judgment in a Multi-level Marketing Experiment" in Journal of Consumer Affairs.

MLM Disclosure Experiment- Graphs

Austin M. Miller 7/30/2022

- Introduction

- Load Packages

- Read Data

- Distributions of Key Variables, by Treatment Group

- Correlation of Interest v. Earnings

- Better-than-average Effect

Introduction

This document presents the R script that I wrote to create graphical summaries of key variables in the data generated by a recent Amazon Mechanical Turk survey experiment. The goal of the analysis was to assess the impact of voluntary income disclosures in MLM marketing materials on consumer interest and earnings expectations. All participants were introduced to an MLM opportunity using marketing materials from the website of an actual MLM firm. The control group did not receive any income disclosure information; treatment group 1 received the income disclosure document created by the MLM firm itself; and treatment group 2 received an augmented form of the firm’s income disclosure information that included a graph and presented how many participants in the firm actually earned zero dollars. The analysis from this experiment was recently accepted for publication as “Income Disclosure and Consumer Judgment in a Multi-level Marketing Experiment” in Journal of Consumer Affairs.

Load Packages

library(tidyverse)

library(stringr)

library(modelr)

library(broom)

library(lmtest)

library(sandwich)

library(stargazer)

Most of these packages are not actually used in this script; many of them are just included in most of my R scripts by default.

Read Data

mlm <- readRDS("data/mlm_2022_clean.rds")

This line reads in the data created by the MLMExperiment_data.Rmd

document.

Distributions of Key Variables, by Treatment Group

Interest

ggplot(mlm, aes(interestg)) +

geom_bar() +

facet_wrap(vars(treatment),ncol=1, strip.position = "left")+

theme_classic()+

scale_x_discrete(labels =c("7- Extremely Interested"="7- Extremely\nInterested"))+

xlab("Interest")+

ylab("Observations")+

labs(title="Distribution of Expressed Interest, by Treatment")

ggsave("graphs/h_interest.png",width=6,height=5)

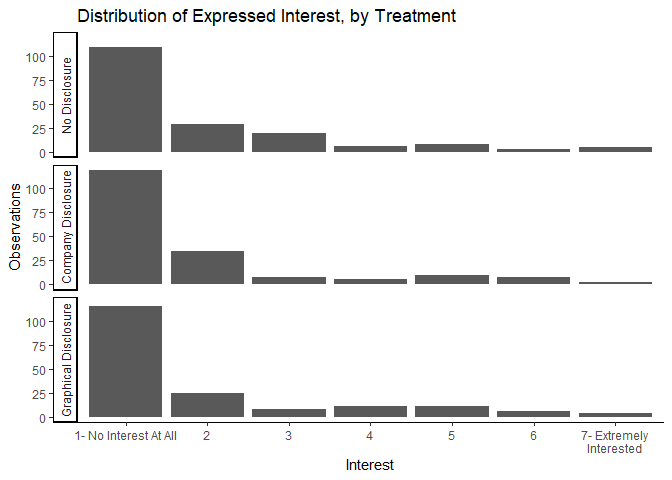

We have two big takeaways here. First, most people report absolutely no interest in wanting to know more about the MLM opportunity proposed to them in this experiment. Second, the distribution of interest appears to be mostly unchanged by either treatment.

Estimated Earnings

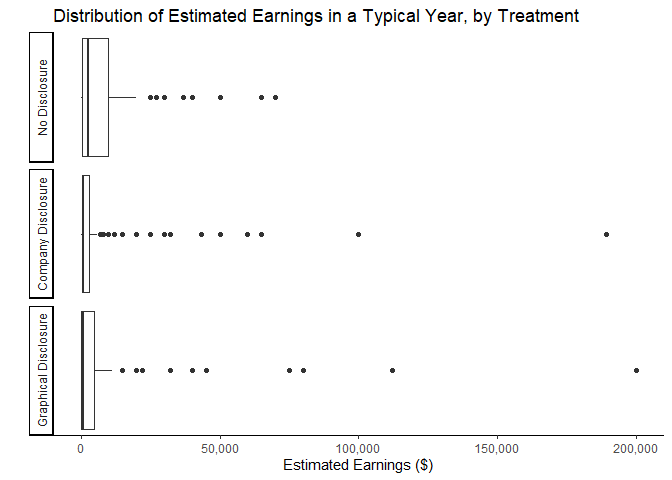

Because estimated earnings are continuous rather than being in seven

bins like interest, the following graphs are box plots rather than

column histograms.

ggplot(mlm, aes(earnings)) +

geom_boxplot() +

facet_wrap(vars(treatment), ncol=1, strip.position = "left")+

theme_classic()+

theme(axis.ticks.y = element_blank(),

axis.text.y = element_blank())+

scale_x_continuous(labels = scales::comma)+

xlab("Estimated Earnings ($)")+

ylab("")+

labs(title=paste("Distribution of Estimated Earnings in a Typical Year, by Treatment"))

ggsave("graphs/b_earnings.png",width=6.5,height=5)

Two interesting, simultaneous effects can be observed in this graph. First, it appears that both treatments lower the majority of estimated earnings. This can be seen by the boxes in the bottom two panels being compressed and closer to zero relative to the top panel. The second effect is that some minority of respondents actually have significantly higher estimates after observing either version of the MLM’s income disclosure information. Those with higher estimates of earnings may be subject to an anchoring effect of having seen some higher earnings numbers in the disclosures than they would have imagined on their own.

ggplot(mlm %>% filter(earnmost<5000000)) +

### excludes one value: 10,000,000

geom_boxplot(aes(x=earnmost)) +

facet_wrap(vars(treatment), ncol=1, strip.position = "left")+

theme_classic()+

theme(axis.ticks.y = element_blank(),

axis.text.y = element_blank())+

scale_x_continuous(labels = scales::comma)+

xlab("Estimated Earnings ($)")+

ylab("")+

labs(title=paste("Distribution of Estimated Most Earnings", "\n",

"(one outlier removed: 10,000,000 in Company Disclosure)"))

ggsave("graphs/b_maxearn.png",width=6.5,height=5)

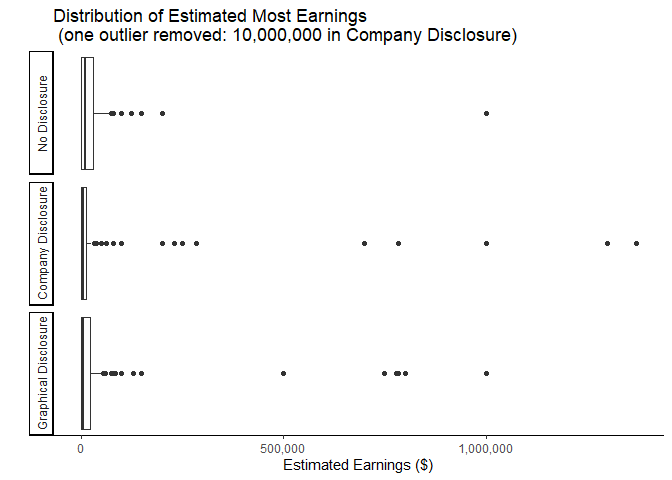

The two competing effects observed in the estimated Typical Earnings are more prominent when we look at the estimated Most Earnings. Again, the boxes are more compressed with values closer to zero at the same time we see a greater number of high-value outliers. This makes sense as presumably the most a person could earn is more dependent on the maximum earnings observed in an income disclosure. The marketing materials shown to all subjects in this study included mentions of some distributors who had earned more than $1 million. The Company Disclosure contains one instance of a value over $1.3 million, but the highest number displayed in the Graphical Disclosure is closer to $780,000. We can observe the apparent anchoring effect of these values in the graph above.

ggplot(mlm %>% filter(earnleast<150000)) +

### excludes 1 values: 165,000

geom_boxplot(aes(x=earnleast)) +

facet_wrap(vars(treatment), ncol=1, strip.position = "left")+

theme_classic()+

theme(axis.ticks.y = element_blank(),

axis.text.y = element_blank())+

scale_x_continuous(labels = scales::comma)+

xlab("Estimated Earnings ($)")+

ylab("")+

labs(title=paste("Distribution of Estimated Least Earnings", "\n",

"(one outlier removed: 165,000 in Company Disclosure)"))

ggsave("graphs/b_minearn.png",width=6.5,height=5)

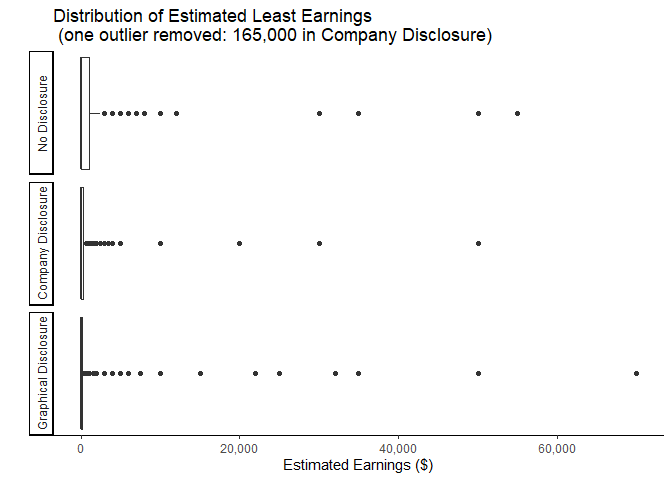

When we look at the distributions of expected Least Earnings, we still observe the downward shift from the income disclosure treatment but without the corresponding increase in outliers observed in the distributions of Typical Earnings and Most Earnings. This again makes sense if the increase in outliers is due to an anchoring effect of observing specific values in the income disclosures. When considering the least a person could earn, the value with the strongest anchoring effect would be zero as that is the minimum that any person can earn. This effect will only strengthen the downward pressure of treatment.

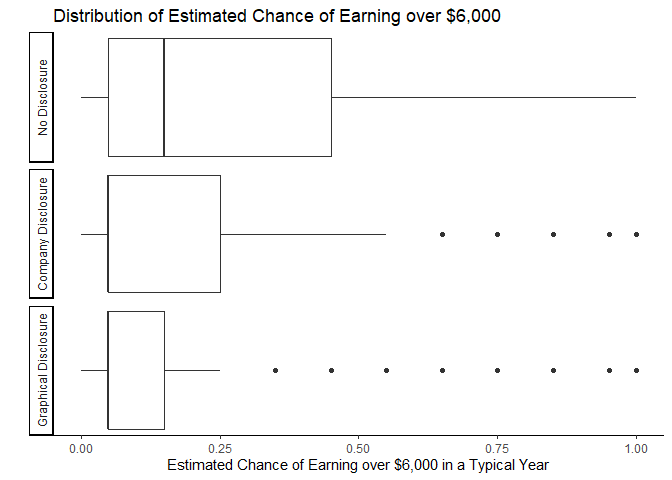

ggplot(mlm, aes(over6)) +

geom_boxplot() +

facet_wrap(vars(treatment), ncol=1, strip.position = "left")+

theme_classic()+

theme(axis.ticks.y = element_blank(),

axis.text.y = element_blank())+

xlab("Estimated Chance of Earning over $6,000 in a Typical Year")+

ylab("")+

labs(title = paste("Distribution of Estimated Chance of Earning over $6,000"))

ggsave("graphs/b_over6.png",width=6.5,height=5)

The marketing materials also mentioned the possibility of $500 of monthly income, which would equal $6,000 in a year. When we ask respondents the likelihood of them earning more than this value, we clearly observe another example of a negative pressure of income disclosures on earnings estimates. As the value of this variable has a maximum at 100 percent, we are unlikely to observe the same effect of a few relatively high values like we see in the distributions of Most Earnings or Typical Earnings. Additionally, neither income disclosure provides any additional information about this likelihood and so is unlikely to have any anchoring effects.

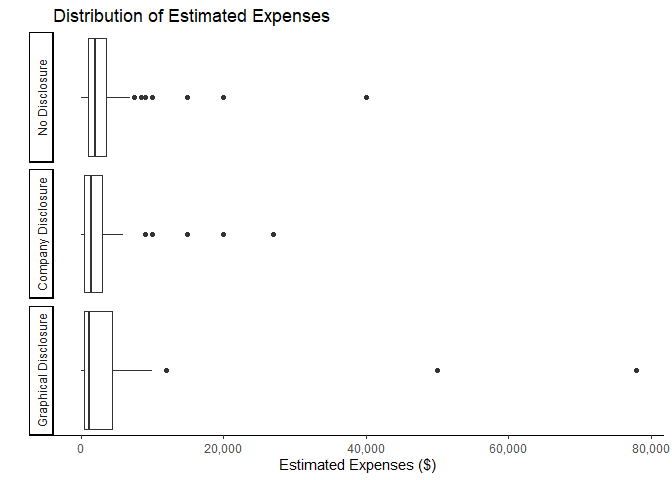

ggplot(mlm %>% filter(!is.na(expenses))) +

geom_boxplot(aes(expenses)) +

facet_wrap(vars(treatment), ncol=1, strip.position = "left")+

theme_classic()+

theme(axis.ticks.y = element_blank(),

axis.text.y = element_blank())+

scale_x_continuous(labels = scales::comma)+

xlab("Estimated Expenses ($)")+

ylab("")+

labs(title="Distribution of Estimated Expenses")

ggsave("graphs/b_expenses.png",width=6.5,height=5)

Finally, respondents in this experiment were never given any information (either from the marketing materials or the income disclosure documents) about potential expenses. It is not surprising, therefore, that we observe no obvious pattern in the distributions of estimated expenses across treatment groups.

It is also worth noting that respondents were not required to enter a value for estimated expenses and many chose to leave this question blank. For that reason, I filtered out all the observations with missing values before generating the graph.

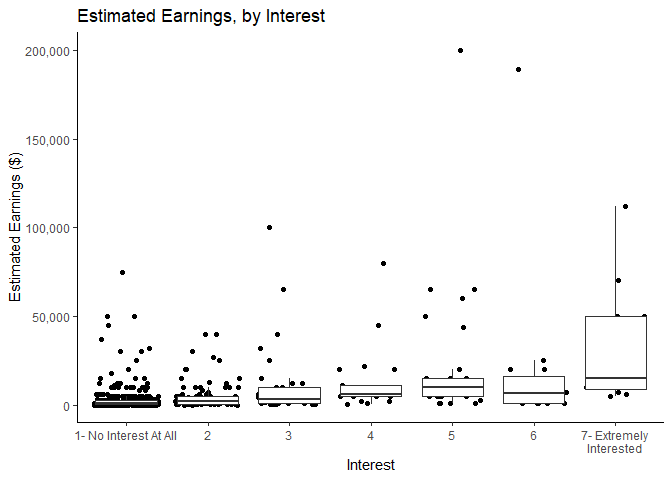

Correlation of Interest v. Earnings

People may be interested in participating in an MLM opportunity for many reasons (e.g., entrepreneurial orientation, reward responsiveness, materialism, relationship to recruiter, or income needs). To the extent that interest is tied to a desire to earn money, we may expect that those with lower expected earnings will also have lower interest. This is of particular concern for the analysis as it appears that the interest of most people is not affected by the income disclosures. If interest and expected earnings are highly correlated, it may be the case that some of those who have lower estimated earnings due to being presented with the income disclosure information will have lower interest even if most people’s interest remains unaffected.

ggplot(mlm,aes(y=earnings,x=interestg))+

geom_jitter()+

geom_boxplot(outlier.shape = NA)+

theme_classic()+

scale_x_discrete(labels =c("7- Extremely Interested"="7- Extremely\nInterested"))+

scale_y_continuous(labels = scales::comma)+

xlab("Interest")+

ylab("Estimated Earnings ($)")+

labs(title="Estimated Earnings, by Interest")

ggsave("graphs/InterestvEarnings.png",width=6,height=4.5)

It is obvious that most people have both low interest and low earnings expectations. It does also seem that the distribution of expected earnings trends upward as interest increases.

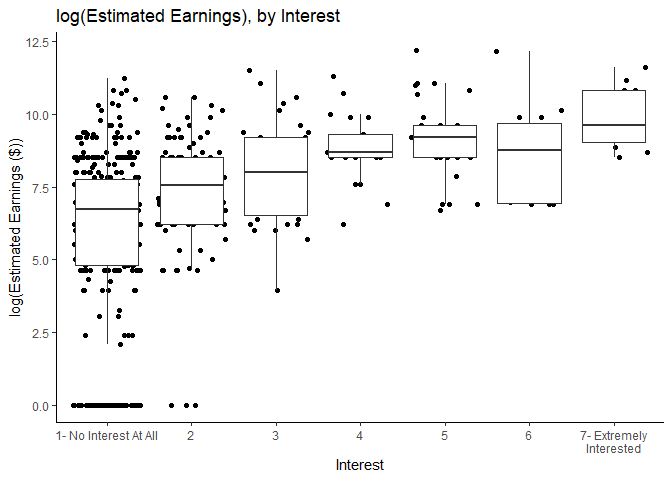

ggplot(mlm,aes(y=learnings,x=interestg))+

geom_jitter()+

geom_boxplot(outlier.shape = NA)+

theme_classic()+

scale_x_discrete(labels =c("7- Extremely Interested"="7- Extremely\nInterested"))+

scale_y_continuous(labels = scales::comma)+

xlab("Interest")+

ylab("log(Estimated Earnings ($))")+

labs(title="log(Estimated Earnings), by Interest")

ggsave("graphs/interestvlearnings.png",width=6,height=4.5)

The pattern becomes more apparent when we look at the distribution of the logarithm of estimated earnings by interest level.

Better-than-average Effect

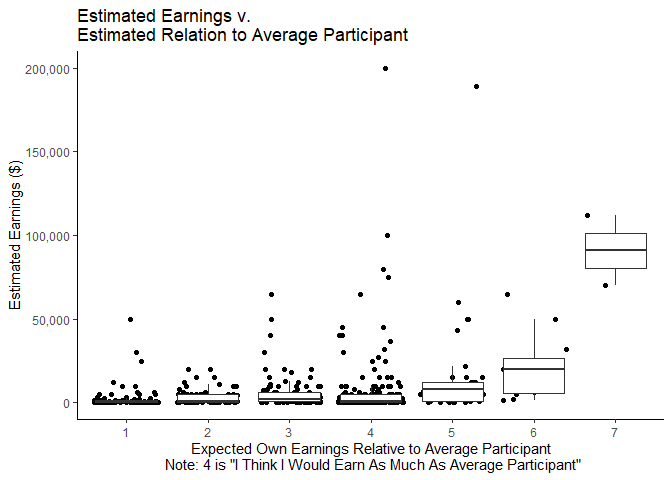

To test the hypothesis that some people respond to income disclosures differently—specifically by focusing more on the higher values than on the far-more-likely lower earnings reported—because they believe that they are somehow more likely to earn more than most people, we include in our analysis a measure of how each person believes their own personal estimated earnings compare to those of the average participant. Preliminary to including this variable in the analysis, we can observe how this self-perception score correlates with both estimated earnings and interest in the MLM opportunity.

ggplot(mlm,aes(y=earnings,x=as.factor(earnbta)))+

geom_jitter()+

geom_boxplot(outlier.shape = NA)+

theme_classic()+

scale_y_continuous(labels = scales::comma)+

xlab("Expected Own Earnings Relative to Average Participant\n Note: 4 is \"I Think I Would Earn As Much As Average Participant\"")+

ylab("Estimated Earnings ($)")+

labs(title="Estimated Earnings v.\nEstimated Relation to Average Participant")

ggsave("graphs/BTAvEarnings.png",width=6,height=4.5)

As is consistent with tasks generally presumed to be more difficult or complex, most people in this experiment report a comparison score of less than 4 indicating that they believe that they would earn less than the average participant. We also see that those who believe they will make more than the average participant tend to have higher estimated earnings, which makes sense.

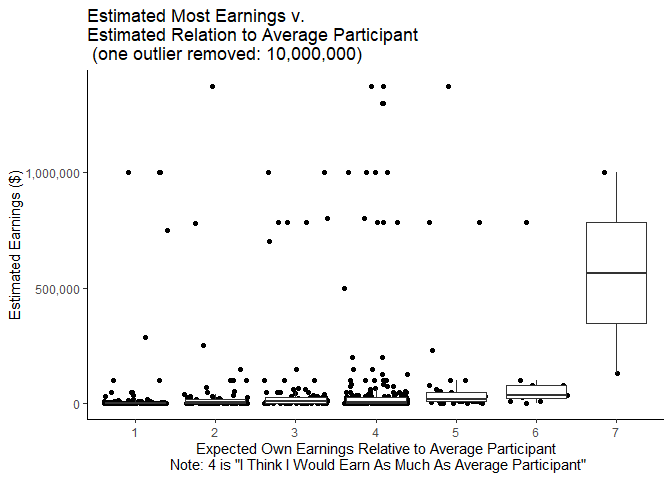

ggplot(mlm %>% filter(earnmost<10000000), aes(y=earnmost,x=as.factor(earnbta)))+

geom_jitter()+

geom_boxplot(outlier.shape = NA)+

theme_classic()+

scale_y_continuous(labels = scales::comma)+

xlab("Expected Own Earnings Relative to Average Participant\n Note: 4 is \"I Think I Would Earn As Much As Average Participant\"")+

ylab("Estimated Earnings ($)")+

labs(title=paste("Estimated Most Earnings v.\nEstimated Relation to Average Participant","\n",

"(one outlier removed: 10,000,000)"))

Interestingly, when we look at the distribution of expected Most Earnings, it seems that some people of all comparison scores report being able to earn nearly $1 million or more. This provides evidence not only that are some people influenced by an anchoring effect due to certain numbers appearing on income disclosures but also some people are probably answering the question “What is the MOST you think you could earn in a year?” in terms of the most possible that ANYONE is likely to earn rather than maximum of what they reasonably believe they themselves could earn.

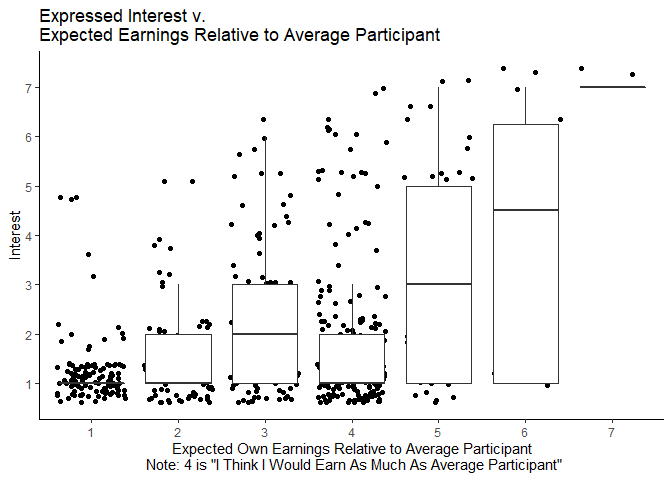

ggplot(mlm,aes(y=interest,x=as.factor(earnbta)))+

geom_jitter()+

geom_boxplot(outlier.shape = NA)+

theme_classic()+

scale_y_continuous(breaks=c(1:7))+

xlab("Expected Own Earnings Relative to Average Participant\n Note: 4 is \"I Think I Would Earn As Much As Average Participant\"")+

ylab("Interest")+

labs(title="Expressed Interest v.\nExpected Earnings Relative to Average Participant")

ggsave("graphs/BTAvInterest.png",width=6,height=4.5)

Finally, it is no surprise that those who believe they will earn more than the average participant also tend to have more interest in the opportunity.